When Waiting Costs You More (Part 2): The Risks That Don’t Show Up in Spreadsheets

The unseen tradeoffs behind “maximizing” Social Security—where the real costs aren’t measured in dollars, but in time, flexibility, and peace of mind.

In Part 1, we explored two often-overlooked downsides of delaying Social Security: liquidity risk and sequence-of-returns risk—how waiting for a bigger check can quietly drain your portfolio and flexibility.

However, the less quantifiable risks, which are tied to policy, psychology, and lifestyle, often have a far greater impact on your actual retirement experience. These don’t show up on spreadsheets, but they shape your peace of mind, health, and happiness.

Note: This article discusses U.S. Social Security rules and strategies. While the principles of timing, income stability, and behavioral decision-making apply globally, the specifics here relate to the U.S. system.

We touch on these less quantifiable risks in Part 1. Today, let’s dive deeper into the rest of these risks.

3. Policy Risk: Betting on Washington’s Promises

Social Security isn’t exactly “going broke,” but it is facing a financial challenge. By the 2030s, the program’s trust fund reserves are expected to run out unless Congress takes action. That doesn’t mean benefits will vanish—but it could lead to lower payments or higher taxes for those with moderate to high incomes.

Imagine Tom and Carol, both aged 64. They plan to delay until age 70, relying on full benefits plus the 8% annual growth from deferral. They’ve read the headlines but assume “Congress will figure it out.”

Here’s the catch: Washington’s “fixes” rarely happen without tradeoffs. If future reforms include means-testing, progressive benefit trimming, or taxing higher-income retirees, the very group that can afford to delay—the higher earners—could be the most affected.

Consequences

Reduced or restructured benefits: Future reforms may lead to lower cost-of-living adjustments (COLAs) or caps on benefits for high earners.

Tax creep: More of your Social Security could become taxable due to inflation-unadjusted thresholds.

Inflation mismatch: Delaying benefits assumes they will keep their real purchasing power, but if COLA formulas change, that assumption falls apart.

My Fiduciary Lens

When advising clients, I don’t make predictions about Congress; I focus on building flexibility around it. Policy risk isn’t a reason to panic, but it is a reason not to rely solely on a promise from Washington.

Approaches

Diversify income sources. Don’t rely solely on Social Security as your main support. Combine it with private pensions, Roth income, or even annuity ladders (if this is in line with your goals) for added policy security.

Stress-test your plan. Model scenarios with 10–15% lower benefits or higher taxation to see if your plan still holds.

Claim flexibility. If policy uncertainty unsettles you, partial early claiming or split spousal strategies can mitigate both timing and legislative risks.

4. Regret Risk: The Emotional Hangover of “What If”

Money math doesn’t include missed memories.

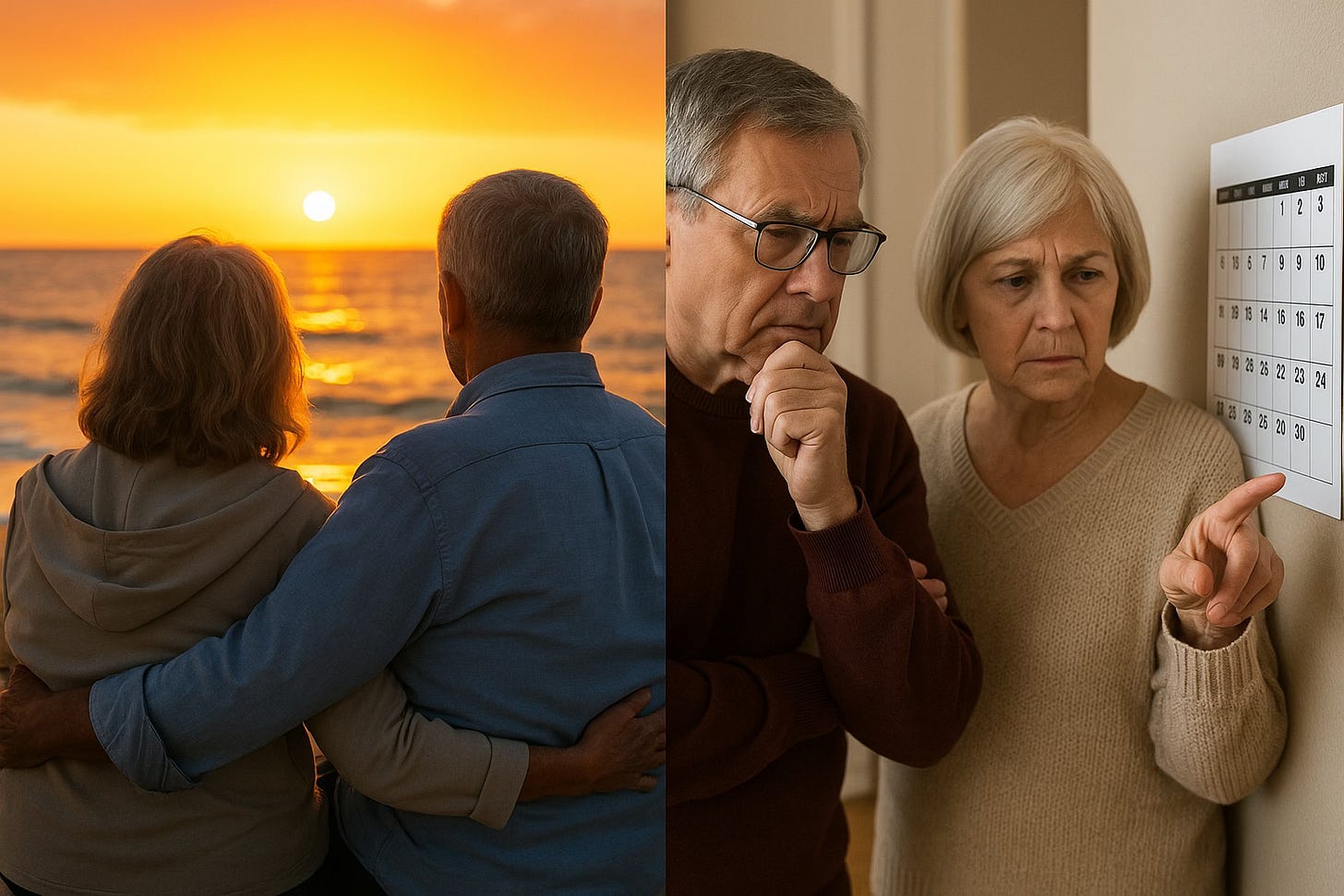

Ellen, for example, waited until age 70 to claim benefits, wanting to “maximize” the benefit. But when her husband suffered a stroke at age 68, their long-awaited travel dreams evaporated. The extra income arrived, but the window for joy had closed.

That’s the regret risk—the emotional toll of realizing that in optimizing the numbers, you might have sacrificed your life.

Consequences

Emotional loss: The pain of “we should have...” can be more burdensome than any financial loss.

Lifestyle paralysis: Fear of “getting it wrong” leads some to completely freeze their decision-making.

Relationship strain: When one spouse’s decision to delay limits shared experiences, the emotional impact worsens.

Approaches

Redefine “optimal.” Optimal isn’t just about the highest dollar amount—it’s about the strategy that maximizes life satisfaction.

Conduct a “joy audit.” Ask: What do I want to experience during my healthiest years—and what income do I need to make that happen?

Create a hybrid plan. Begin one spouse’s benefit early to support lifestyle goals while delaying the other for longevity protection.

Regret isn’t a line item in your financial plan, but it’s a very real part of retirement psychology. Don’t let “waiting for more” cost you the memories you can’t replace.

5. Health-Span Risk: Time Isn’t Equal in Retirement

It’s not about how long you live—it’s about how well you live.

The healthiest years—your “go-go years”—often happen in the first decade of retirement. That’s when your knees still cooperate, your energy is high, and those bucket-list adventures feel truly doable.

Keep reading with a 7-day free trial

Subscribe to WellthFusion™ to keep reading this post and get 7 days of free access to the full post archives.